At the moment it is relentless. I suppose I should take it as a compliment, but every day, sometimes several times per day some new account masquerading as me pops up. I block, report and delete as soon as I get wind of it, but I can’t be in front of my computer 24/7. Please be aware: I don’t use Telegram. I never invite people to chat on WhatsApp. So if somebody who appears to be me solicits you to join them on Telegram, WhatsApp or anywhere else, it is not me. It is someone who is trying to scam you.

Let me start today’s note with a very warm welcome to the many new readers who have signed up the Flying Frisby.

Many have signed up because of the recent promotion for Lifetime Membership. That ends today, so if it’s caught your eye, time is running out. For a one-off payment of just £450/$570 you will get full access to the Flying Frisby for life.

Click the button below and you will see the option - I stress this is a one-off payment

Today, with stock markets looking very wobbly indeed, I thought it would be a good time to check in on the Dolce Far Niente portfolio.

Dolce Far Niente, as I’m sure you know, means “the sweetness of doing nothing”, and the idea was to create a strong, long-term portfolio

which will grow and thrive

with which you will not have to constantly tinker

about which you will not to have to constantly worry.

You can just leave it alone and let it be.

It emphasises strategic asset allocation - being in the right market - above individual stock picking.

So, with so many new readers, and with it being six months since we last looked, let’s check in on it today.

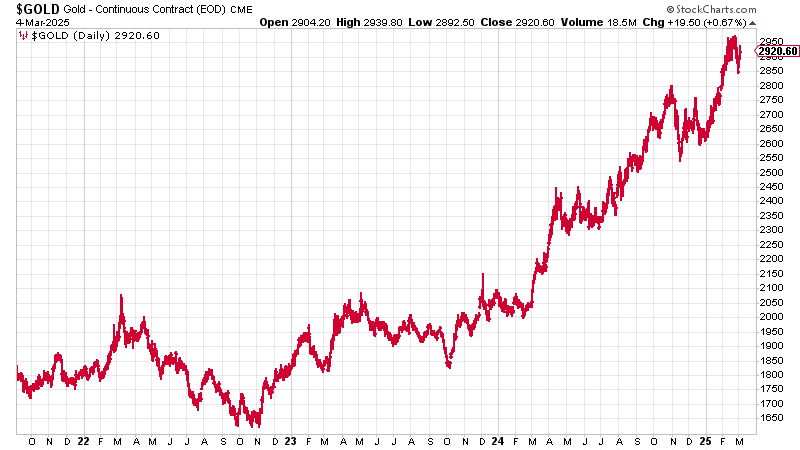

1 Gold (15% allocation)

Gold is the ultimate Dolce Far Niente asset. It does nothing but sit there and look sweet. The shine may be coming off everything else, but it will never come off gold.

It’s up 55% since inception in October 2023 and going strong.

My firm belief is that everyone should own some gold. Especially now.

My guide to investing in gold is here. If you are looking to buy gold, try the Pure Gold Company.

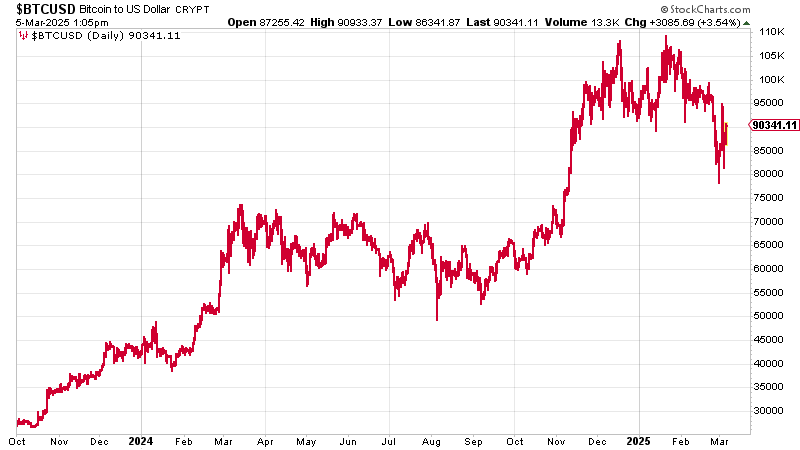

2. Bitcoin (5% allocation)

HODL is another way of saying Dolce Far Niente, and, even with the current shake out, bitcoin has been another winner. It has more than tripled since inception (a 233% gain).

Some will argue bitcoin has no place in a “low risk” portfolio such as this. I’d argue that the greater risk is not owning bitcoin.

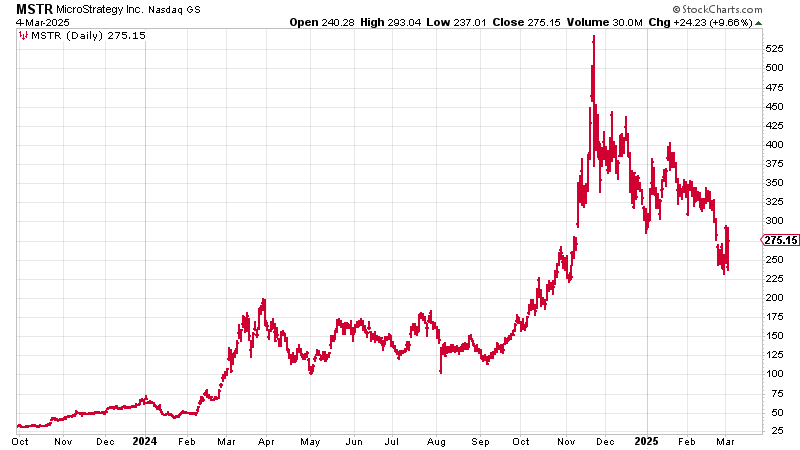

For those in the UK who can’t buy it directly or buy the ETFs, our vehicle to play bitcoin via a UK-broker, and circumvent/satisfy ill-conceived-FCA regulation, was to own Nasdaq-listed Strategy Inc (Nasdaq:MSTR).

This is one volatile stock, and the chart now looks nasty, but its President Michael Saylor is a genius. He embraces volatility, seeing it as a feature not a flaw. And the company has been another winner, up 9x since the inception of the portfolio, even after the recent correction.

By the way, Strategy is proving a leading indicator for bitcoin - it was already falling when bitcoin was re-testing its old high. That makes it a super-useful forecaster. Take note.

3. Special Situations (10%)

This is the fun/painful part of the portfolio.

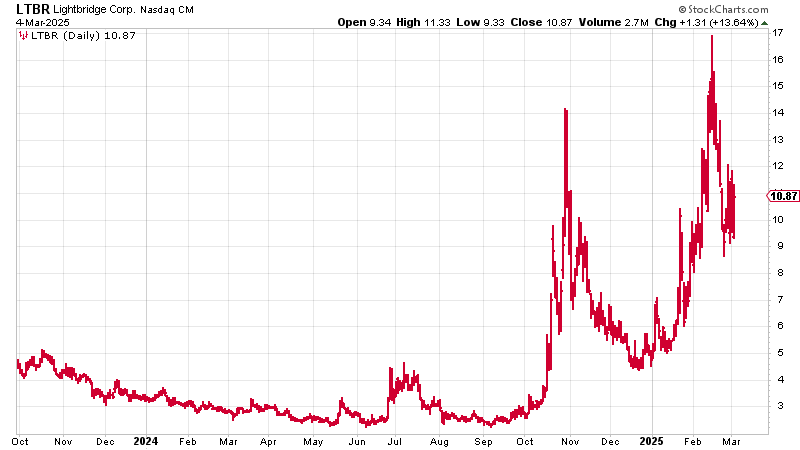

Lightbridge (NASDAQ:LTBR) was a big winner here, as was and the tax-loss trade (time to exit this one if you haven’t already). Junior miners, Condor and tax-loss trade aside, continue to suck.

By the way, check out this nuts Lightbridge chart. The bots must have got hold of it. Surely one be one to buy on the dips and exit on the spikes.

4. Uranium (5% allocation, reduced to 2.5%)

I reduced the uranium allocation to 2.5% in February 2024, because it all felt too frothy. That has proved a good decision, as the price has since come down. We are in proper bear market now.

I don’t like uranium miners. Most of them will not see any production for years, decades even and are, therefore, drains on capital. We own the metal itself.