If the stories are to be believed, and the first casualty of war is truth and all that, Venezuelan President Nicolas Maduro sent some 3.6 million ounces of gold - $16 billion in today’s money - to Switzerland before 2017, when the EU brought sanctions against Venezuela.

Switzerland last week froze his accounts and the accounts of some 36 others with close ties. We don’t know how much money he had in them, or how many accounts there were, but the figure doing the rounds is $10 billion.

It has also emerged that Tether has been freezing “wallets identified as being involved in the Venezuelan oil trade.” As much as 80% of Petroleos de Venezuela’s oil revenue is believed to be transacted in tether. This could be a total figure in the billions too.

We also know that Venezuela was mining bitcoin for many years - when the price was a lot lower - but we don’t know what they did with the coins. Did they fall into Maduro’s hands? Were they sold? Were they held?

The number doing the rounds here that it owns 600,000 BTC (~$60 billion). That would put Venezuela up there with Michael Saylor and Strategy. It’s three times the 198,000 coins the US government itself is said to own.

There’s a seed phrase I’d like to know. Where are the keys, I wonder?

And where did the proceeds of Venezuela’s enormous oil, gold and other natural resource exports end up, exactly? Only some of them we know.

At this point we remind you that the Venezuelan currency itself - the bolivar - collapsed in hyperinflation and has little to no value. Beware national currencies, particularly under socialist regimes. They don’t last.

There are several things I take away from all of this.

First, the US dollar - whether via SWIFT or stablecoin - remains the number one international currency of choice, even for America’s enemies.

Second, tether and other US dollar stablecoins might be convenient - you don’t have to use banks - but Tether will do what the US government tells it to do, and if the government wants your assets frozen, Tether will freeze them.

Stablecoins, then, have a central point of failure. If someone can freeze them, they are not sovereign. And just as the US froze Russian US dollar assets after its invasion of Ukraine, so can and will it freeze the stablecoin assets of its enemies too.

What did that 2022 freezing of Russian assets trigger? The mother of all bull markets in gold, and then silver and miners.

What will this freezing trigger? A bull market in bitcoin. Possibly. Likely.

It’s already creeping back up.

While the US does its geo-political, strategic, critical minerals thing, quaint old Western Europe is sinking deeper into higher taxes and - I’m sure they’re coming eventually - capital controls. In fact, capital controls already exist in effect, banks are so heavily regulated and limiting of what you can send and to whom.

The value of permissionless, international money just went up.

You need to own money that they can’t touch, whether by seizure or debasement.

Meanwhile …

Gold and silver continue to go bananas - the latter especially.

So many roads lead to gold at the moment, it’s hard to see when this stops.

The inevitable debasement of national currencies off the back of uncontrollable government spending. Gold. Dedollarisation. Gold. Increasing geo-political uncertainty - Iran, Venezuela. Gold. Reshoring of US industry - highly inflationary. Gold. Revaluation of US gold holdings. Gold. Looming crisis from Japan as yields spike. Gold. China’s ambitions for its currency and trade. Gold. Triffin’s dilemma. Gold. AI putting everyone out of work leading to more money printing. Gold. Declining competence of and as a result faith in institutions worldwide. Gold.

The dollar has now fallen to a 40% share of global central bank reserves, while gold is now at 30% on the back of its higher price and central bank accumulation. (Note currency and reserves are not the same).

We are in a major capital rotational event the like of which occurs only every few decades.

Typical portfolios are still underweight gold.

If you live in a Third World Country such as the UK, I urge you to own gold or silver. The pound is going to be further devalued. The bullion dealer I recommend is The Pure Gold Company. Pricing is competitive, quality of service is high. They deliver to the UK, US, Canada and Europe or you can store your gold with them. More here.

Own both

As regular readers will know, I advocate owning both bitcoin and gold. The two assets have many similarities in that they are non-government, independent money. But the fundamental difference is that one is physical and one is digital.

Both have their uses, and I have little patience with this notion that one must choose one or the other.

In that regard, as with many others, my worldview is aligned with that of Charlie Morris (whose newsletters I urge you to subscribe to. There are lots of free options, including Atlas Pulse, which I love). Remember many years ago Charlie was calling for $7,000 gold by the end of this decade and many thought he was dotty. His call is looking perfectly sensible now, which it was - and which he is.

Charlie previously managed a multi-billion-dollar fund for HSBC, before going solo. Aside from his newsletter, one his main endeavours has been BOLD, and he has been trying to get it listed for years. But the UK’s Financial Conduct Authority is retarded.

BOLD is a fund you can buy through a broker which is 75% gold and 25% bitcoin - all properly audited and backed, of course, with institutional-grade custody.

Over the past five years, BOLD has returned 186%, while bitcoin has returned 202%, gold 128%, and equities 77%. The average return of bitcoin and gold together was 165%, yet BOLD was 21% ahead. This is because every month Charlie rebalances the portfolio, effectively buying more of whichever is the weaker asset to retain that 75:25 ratio. This act of rebalancing both strips out the volatility and increases the gains.

Since Charlie first conceived of it in 2017, over pretty much any timeframe, BOLD (in blue) has beaten everything.

Since its listing in Europe in 2022 BOLD has returned 123% since launch (in GBP to end 2025 including fees) compared to 111% for bitcoin and 113% for gold.

It would have been nice to have been able to enjoy these gains in the UK. Thank goodness the FCA has protected us from them.

Not for much longer.

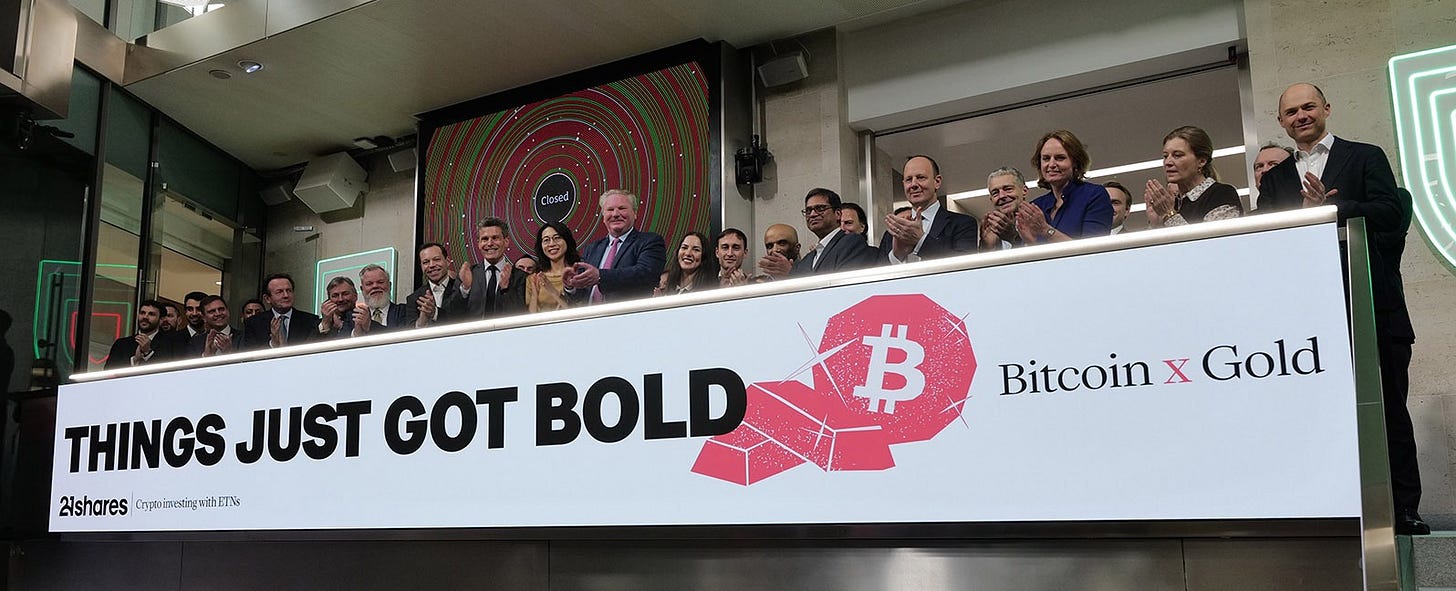

I was delighted to be at the London Stock Exchange yesterday to see the listing of this product which delivers “bitcoin-like returns with the lesser volatility of gold.”

Congratulations, Charlie, for finally getting this listed. I wish you every success.

Now we can actually invest.

Obviously, if gold AND bitcoin both turn down, BOLD will suffer. But this is a classic buy-and-forget product, perfect for the Dolce Far Niente portfolio. You can own it in your pension, your ISA and it should become a mainstay of any portfolio.

The 21Shares Bitcoin Gold ETP, BOLD, has the ticker LSE:BOLD.

I am a buyer.

PS some brokers such as AJ Bellend have only made this product available to pro investors. The broker I use is Interactive Investor, who are pretty good about getting these kinds of things live. If you open an account via this link you get a year’s free. I am just on the phone to them now to get this listed.

Disclaimer:

The Flying Frisby is not regulated by the Financial Conduct Authority (FCA) or any other regulatory body as a financial advisor. Therefore, any information provided in this newsletter does not constitute regulated financial advice. It is solely an expression of opinion. Please conduct your own due diligence and consult with a financial advisor, if you have any doubts. Remember, markets can both rise and fall, especially in the case of small and mid-cap stocks. I am not aware of your individual financial circumstances, so only invest money that you can afford to lose.