“Pound crashes to weakest level since 1985 in blow to Truss” ran the headline on the Telegraph website yesterday.

“The Bank of England had one job today”, as economist Shaun Richards put it, “which was to talk up the pound and instead their waffling sees it at US $1.14.” Theresa May Flash Crash aside, that’s a 37-year low.

And that’s measuring it against the dollar. If you measure the pound’s purchasing power against essential basics such as energy or houses, its performance has been way more woeful.

It’s not just the pound, even if it is one of the worst offenders. It’s all fiat money. I’ve been banging on about it for 20 years but I may as well bang on some more: fiat money and its devaluation is the greatest and most pernicious intergenerational theft in history.

Devaluing your currency boosts assets but devalues labour

When you devalue money, among numerous other things, you devalue salaries, which is to devalue labour. All the young have is their labour. You boost the value of assets meanwhile, which is what the old have acquired over the course of their lives. The net result is to transfer wealth from young to old. Compounded over decades, 5% one year, 8% another, this process has been devastating. Don’t get me started on the knock-on effects: smaller families started later in life and all the rest of it.

So many people of my generation and above think they are business geniuses because they paid the market rate for a house 30 or 40 years ago. You are not. Systematic and incremental devaluation by successive administrations was “what did it”.

The Bank of England, the Federal Reserve Bank, the European and Japanese Central Banks – central banking has a lot to answer for.

It feels like we might finally be in some kind of endgame for fiat money now. Mind you, I thought we were in the endgame in 2008, so I’m probably wrong this time around as well. I’ve no doubt some new magic words even more unintelligible than “quantitative easing” are being conjured up as I write.

Right rant over. I had to get that off my chest. Let us move on.

Does a new PM mean you should go long the pound?

We have a new government. Money is the issuance of government. The weak pound is all over the headlines. So I thought it would be an interesting exercise today to look, first, at the performance of the pound by successive governments over the past generation. And then to consider whether one should be buyer or seller here.

“Buy on silence, sell on headlines,” is a good little investment motto that I’ve just invented. When something makes the headlines, there is often not a lot of narrative left in the tank, the story is mature and the next stage is exhaustion. It’s standard contrarian market psychology. Does the fact that the weak pound has made the headlines mean it’s time to take the other side of the trade and go long? Could be.

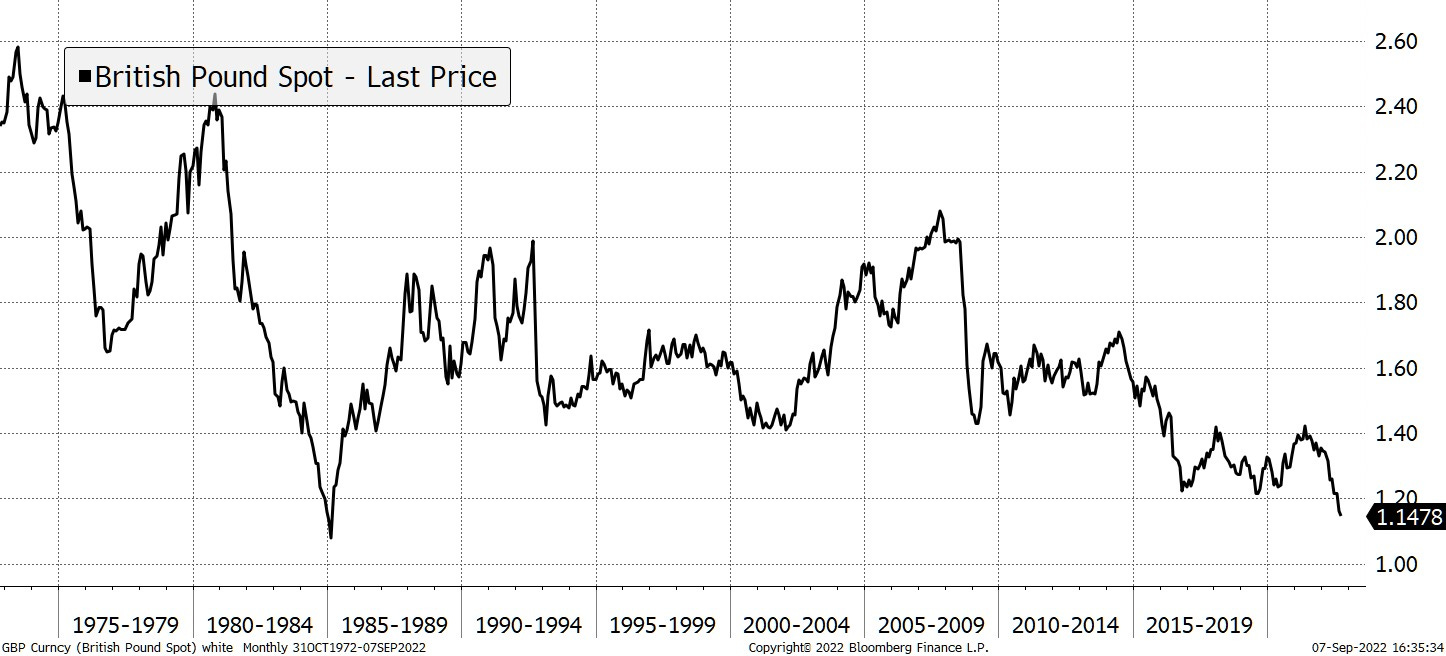

We’ll start with a chart of the pound against the dollar – aka cable – since 1970. And by the way, the dollar has a much larger market cap than the pound, so what is going on on the other side of the pond tends to have a greater effect on cable than what is happening here. That is the case at present. The pound is weak, but so is the euro, the yen and any other number of currencies you care to mention – except the Russian rouble. Current pound weakness is as much a function of US dollar strength as anything. The chart of the pound against the euro over the last three years is much flatter.

In any case, cable is the benchmark, so here is the pound against the dollar since 1970, when it was $2.40 (!).

The broader trend is down, but there are periods of relative strength – 1976-1981, 1985-1991, 2000-2007. We’ve basically been in a downtrend since 2007, shortly after Tony Blair stood down and Gordon Brown became PM. It is what is known in the game as a secular bear market.

Now we consider the same chart, but this time I have overlaid the government. Even though several prime ministers have led successive governments – Wilson, Thatcher, Major and Blair for example – for the sake of clarity and simplicity I have marked the chart by PM. Needless to say the dates of the red and blue lines are approximate.

The first observation I make is that, despite their reputation for fiscal competence, the Tories have not been good stewards of the currency. In the case of Edward Heath and David Cameron, the pound was marginally stronger when they stood down than it was when they took office. Despite his presiding over Black Wednesday and the ERM fiasco, for John Major the pound was only a few per cent lower than it was when he started.

But in the case of – and this surprised me – Margaret Thatcher, plus Theresa May and Boris Johson it was lower.

Labour’s record is mixed. Harold Wilson saw it lower, Jim Callaghan higher (that surprised me too). Tony Blair has the best record of all – it went from roughly $1.60 to $2.10 – and Gordon Brown the worst.

That said Blair was one of the few PMs – perhaps the only one – to stand down from a position of strength. Normally PMs are stood down because there is something voters or MPs or both are not happy with, which will be reflected in a weak currency.

Lower taxes and higher spending should encourage growth

Back to today. This latest move in the dollar has been extraordinary. I’ve long been suggesting the US dollar index could go as high as 120 (another 10% from here – though exhaustion indicators are starting to appear), but at a certain point purchasing power parity will kick in and currencies will reflect relative valuations. On a purchasing power parity basis the pound is very cheap at $1.14.

The other observation I make about the above chart is that new administrations have often marked turning points in the currency. This, one could argue, was the case for Wilson, Callaghan, Major, Brown, Cameron, May and Johnson.

Despite the Tories’ record for incompetence, Liz Truss has put together a cabinet that is, broadly speaking, actually conservative. Unlike previous administrations, it is not full of wets and social democrats, who happen to be in the Conservative Party. Lower taxes and less spending (I’ll believe that when I see it) should lead to economic growth, which should help the currency. The big kahuna though is where the Bank of England base rate goes – and indeed the Fed Funds Rate.

I’d say there is a not unreasonable chance that, with a new government, we could mark a turning point for the pound. We’re at a point of extremity where such a turn could happen. But let’s see what government does first, before we get too excited. As I say, another not totally unreasonable possibility is that we are in the endgame for fiat. In that case the pound slides below parity.

If you want to buy gold to hedge yourself against all of this, my recommended bullion dealer is the Pure Gold Company with whom I have an affiliation deal.

If you are in London on September 28 or 29, my lecture with funny bits, How Heavy?, about the history of weights and measures is coming to the Museum of Comedy. It’s a 7-8pm show so you can come along and go out for dinner after. You can buy tickets here. This is a very interesting subject - effectively how you perceive the world. Hope to see you there.

This article first appeared at Moneyweek.